NEWS & UPDATES

NEWS ARCHIVES

2025 News & Updates

Important Notice Regarding City Incentive

HMEPS recently learned that the City of Houston is offering a special incentive to retirement-eligible members. HMEPS is a separate entity from the City and does not administer or have specific details on the incentive, but we will work diligently with retirement-eligible members and the City to process the expected increased number of retirements. We ask that you remember these important steps if you plan to retire soon:

• There is a two-step process for retirement (click here for more details):

1) the HMEPS retirement process, and

2) the separate City of Houston process for documenting your departure from employment.

• HMEPS cannot verify your eligibility to retire until after you submit a request to

apply for retirement to HMEPS and we receive your City employment records.

However, members who currently participate in DROP already received preliminary

verification of retirement eligibility at the time they entered DROP and do not need

to verify eligibility unless they had significant unpaid leave or missed contributions

prior to DROP entry.

HMEPS looks forward to working with you and the City during this unique incentive offering, and we appreciate your efforts in facilitating your retirement.

For more information about retirement eligibility, required documents, and the retirement process, see the HMEPS Benefits Handbook (as of January 2017), available on our website at www.hmeps.org. For information about the City incentive, call your City representative.

___________________________________________________________________________________________

2023 - 2024 News & Updates

DROP Interest Rate for Calendar Year 2025 - Updated October 24, 2024

The Deferred Retirement Option Plan (DROP) interest rate for calendar year 2025 will be 5.44%, effective January 1, 2025. The rate was approved by the HMEPS Board of Trustees at the October 2024 Board meeting.

The DROP interest rate calculation is set forth in the HMEPS Pension Statute. The DROP interest rate as of January 1 of each year is a rate equal to half of HMEPS’ rolling five-fiscal-year investment return net of investment expenses, but not less than 2.5% nor more than 7.5%. The five-year net investment return on HMEPS’ investments as of the end of fiscal year 2024 is 10.88%. Half of 10.88% is 5.44%. Therefore, DROP participants in 2025 will receive 5.44% interest on their DROP accounts.

DROP is an optional retirement method for Group A and Group B members who have reached their normal retirement eligibility (age and years of credited service) but do not want to retire. It is an alternative method of accumulating and receiving a pension benefit from HMEPS. To speak with a benefit counselor to learn more about DROP, please call the HMEPS office at 713-595-0100.

COLA beginning February 1, 2025

The cost of living adjustment (COLA) will be 2.0% beginning February 1, 2025.

The COLA calculation is set forth in the HMEPS Pension Statute. The COLA is equal to HMEPS’ five-year investment return, based on a rolling five-year basis and net of investment expenses, minus the assumed rate of return less two percentage points, and multiplied by 50%, but not less than 0% nor more than 2%. The five-year net investment return on HMEPS’ investments as of the end of fiscal year 2024 is 10.88%, and the 7% assumed rate of return less two percentage points is 5%, and half of the difference between the five-year investment return minus 5% is 2.94%, which is more than the maximum of 2%. Therefore, the COLA is 2.0%. The COLA was approved by the HMEPS Board of Trustees at the October 2024 Board meeting.

The COLA, not compounded, is applied to pension benefits for all group A retirees and group B retirees, and for all group D retirees who terminate employment on or after July 1, 2017 with at least five years of credited service, and survivor benefits for eligible survivors of a former member of group A or group B, or of a former member of group D who terminated employment on or after July 1, 2017 with at least five years of credited service, if such eligible person is receiving a pension or survivor benefit as of January 1 of the year in which the increase is made. For DROP, the COLA, not compounded, is applied only to the DROP account of an active DROP participant who is at least 62 years of age as of January 1 of the year in which the increase is made.

Cash Balance Account Interest Rate for 2025

The Group D Cash Balance Account interest rate will be 0.21% bi-weekly, effective with the first full bi-weekly pay period after January 1, 2025. The rate was approved by the HMEPS Board of Trustees at the October 2024 Board meeting.

The Cash Balance calculation is set forth in the HMEPS Pension Statute. The Cash Balance rate is equal to half of HMEPS’ five-year investment return, based on a rolling five-year basis and net of investment expenses, but not less than an annual rate of 2.5% nor more than an annual rate of 7.5%, divided by 26. The five-year investment return on HMEPS’ investments as of the end of fiscal year 2024 is 10.88%, and half of that return is 5.44%, which when divided by 26 is 0.21%.

The Cash Balance Account is provided under the HMEPS Pension Statute only to Group D members. Interest is credited bi-weekly on a Group D member’s contributions to the account, and is payable to a former Group D member with at least one year of service in the pension plan.

___________________________________________________________________________________________

Results of 2024 Trustee Election – August 29, 2024

In the HMEPS 2024 Trustee Election, Lenard Polk was elected to Active Employee Trustee Position 3, Rhonda Smith was elected to Active Employee Trustee Position 4, and Lonnie Vara was elected to Retiree Trustee Position 7. We would like to congratulate Lenard Polk, Rhonda Smith and Lonnie Vara on their re-election to the Board of Trustees.

The Trustee election was conducted under the independent administration of Election-America, Inc. and certified by the Board at the August 29, 2024 meeting.

2024 Election - Position 3 (Active Employee)

Eligible

Name Votes Cast Percentage

Lenard Polk 317 66%

M. Arif Rasheed 165 34%

2024 Election - Position 4 (Active Employee)

Eligible

Name Votes Cast Percentage

Rhonda Smith 363 74%

Cedrick LaSane 126 26%

2024 Election - Position 7 (Retiree)

Eligible

Name Votes Cast Percentage

Lonnie Vara 752 57%

Gina Goosby-Harris 569 43%

To view the 2024 Trustee Election report, click here.>>

___________________________________________________________________________________________

DROP Interest Rate for Calendar Year 2024 - Updated November 16, 2023

The Deferred Retirement Option Plan (DROP) interest rate for calendar year 2024 will be 5.11%, effective January 1, 2024. The rate was approved by the HMEPS Board of Trustees at the November 2023 Board meeting.

The DROP interest rate calculation is set forth in the HMEPS Pension Statute. The DROP interest rate as of January 1 of each year is a rate equal to half of HMEPS’ rolling five-fiscal-year investment return net of investment expenses, but not less than 2.5% nor more than 7.5%. The five-year net investment return on HMEPS’ investments as of the end of fiscal year 2023 is 10.21%. Half of 10.21% is 5.11%. Therefore, DROP participants in 2024 will receive 5.11% interest on their DROP accounts.

DROP is an optional retirement method for Group A and Group B members who have reached their normal retirement eligibility (age and years of credited service) but do not want to retire. It is an alternative method of accumulating and receiving a pension benefit from HMEPS. To speak with a benefit counselor to learn more about DROP, please call the HMEPS office at 713-595-0100.

COLA beginning February 1, 2024

The cost of living adjustment (COLA) will be 2.0% beginning February 1, 2024.

The COLA calculation is set forth in the HMEPS Pension Statute. The COLA is equal to HMEPS’ five-year investment return, based on a rolling five-year basis and net of investment expenses, minus the assumed rate of return less two percentage points, and multiplied by 50%, but not less than 0% nor more than 2%. The five-year net investment return on HMEPS’ investments as of the end of fiscal year 2023 is 10.21%, and the 7% assumed rate of return less two percentage points is 5%, and half of the difference between the five-year investment return minus 5% is 2.61%, which is more than the maximum of 2%. Therefore, the COLA is 2.0%. The COLA was approved by the HMEPS Board of Trustees at the November 2023 Board meeting.

The COLA, not compounded, is applied to pension benefits for all group A retirees and group B retirees, and for all group D retirees who terminate employment on or after July 1, 2017 with at least five years of credited service, and survivor benefits for eligible survivors of a former member of group A or group B, or of a former member of group D who terminated employment on or after July 1, 2017 with at least five years of credited service, if such eligible person is receiving a pension or survivor benefit as of January 1 of the year in which the increase is made. For DROP, the COLA, not compounded, is applied only to the DROP account of an active DROP participant who is at least 62 years of age as of January 1 of the year in which the increase is made.

Cash Balance Account Interest Rate for 2024

The Group D Cash Balance Account interest rate will be 0.20% bi-weekly, effective with the first full bi-weekly pay period after January 1, 2024. The rate was approved by the HMEPS Board of Trustees at the November 2023 Board meeting.

The Cash Balance calculation is set forth in the HMEPS Pension Statute. The Cash Balance rate is equal to half of HMEPS’ five-year investment return, based on a rolling five-year basis and net of investment expenses, but not less than an annual rate of 2.5% nor more than an annual rate of 7.5%, divided by 26. The five-year investment return on HMEPS’ investments as of the end of fiscal year 2023 is 10.21%, and half of that return is 5.11%, which when divided by 26 is 0.20%.

The Cash Balance Account is provided under the HMEPS Pension Statute only to Group D members. Interest is credited bi-weekly on a Group D member’s contributions to the account, and is payable to a former Group D member with at least one year of service in the pension plan.

___________________________________________________________________________________________

2022 News & Updates

DROP Interest Rate for Calendar Year 2023 - Updated October 27, 2022

The Deferred Retirement Option Plan (DROP) interest rate for calendar year 2023 will be 5.43%, effective January 1, 2023. The rate was approved by the HMEPS Board of Trustees at the October 2022 Board meeting.

The DROP interest rate calculation is set forth in the HMEPS Pension Statute. The DROP interest rate as of January 1 of each year is a rate equal to half of HMEPS’ rolling five-fiscal-year investment return net of investment expenses, but not less than 2.5% nor more than 7.5%. The HMEPS net five-year investment return is 10.85%. Half of 10.85% is 5.43%. Therefore, DROP participants in 2023 will receive 5.43% interest on their DROP accounts.

DROP is an optional retirement method for Group A and Group B members who have reached their normal retirement eligibility (age and years of credited service) but do not want to retire. It is an alternative method of accumulating and receiving a pension benefit from HMEPS. To speak with a benefit counselor to learn more about DROP, please call the HMEPS office at 713-595-0100.

COLA beginning February 1, 2023

The cost of living adjustment (COLA) will be 2.0% beginning February 1, 2023.

The COLA calculation is set forth in the HMEPS Pension Statute. The COLA is equal to HMEPS’ five-year investment return, based on a rolling five-year basis and net of investment expenses, minus the assumed rate of return less two percentage points, and multiplied by 50%, but not less than 0% nor more than 2%. The five-year investment return on HMEPS’ investments as of the end of fiscal year 2022 is 10.85%, and the 7% assumed rate of return less two percentage points is 5%, and half of the difference between the five-year investment return minus 5% is 2.93%, which is more than the maximum of 2%. Therefore, the COLA is 2.0%. The COLA was approved by the HMEPS Board of Trustees at the October 2022 Board meeting.

The COLA, not compounded, is applied to pension benefits for all group A retirees and group B retirees, and for all group D retirees who terminate employment on or after July 1, 2017 with at least five years of credited service, and survivor benefits for eligible survivors of a former member of group A or group B, or of a former member of group D who terminated employment on or after July 1, 2017 with at least five years of credited service, if such eligible person is receiving a pension or survivor benefit as of January 1 of the year in which the increase is made. For DROP, the COLA, not compounded, is applied only to the DROP account of an active DROP participant who is at least 62 years of age as of January 1 of the year in which the increase is made.

Cash Balance Account Interest Rate for 2023

The Group D Cash Balance Account interest rate will be 0.21% bi-weekly, effective with the first full bi-weekly pay period after January 1, 2023. The rate was approved by the HMEPS Board of Trustees at the October 2022 Board meeting.

The Cash Balance calculation is set forth in the HMEPS Pension Statute. The Cash Balance rate is equal to half of HMEPS’ five-year investment return, based on a rolling five-year basis and net of investment expenses, but not less than an annual rate of 2.5% nor more than an annual rate of 7.5%, divided by 26. The five-year investment return on HMEPS’ investments as of the end of fiscal year 2022 is 10.85%, and half of that return is 5.43%, which when divided by 26 is 0.21%.

The Cash Balance Account is provided under the HMEPS Pension Statute only to Group D members. Interest is credited bi-weekly on a Group D member’s contributions to the account, and is payable to a former Group D member with at least one year of service in the pension plan.

___________________________________________________________________________________________

Results of 2022 Trustee Election – August 26, 2022

In the HMEPS 2022 Trustee Election, Sherry Mose was unopposed for election to Active Employee Trustee Position 5, and Roderick J. Newman was unopposed for election to Retiree Trustee Position 8. For Position 6, an active employee trustee position, two candidates were on the election ballot. We would like to congratulate Roy W. Sanchez on his re-election to the Board of Trustees Position 6.

The Trustee election was conducted under the independent administration of Election-America, Inc. and certified by the Board at the August 25, 2022 Board meeting.

2022 Election - Position 6

Eligible

Name Votes Cast Percentage

Roy W. Sanchez 359 64%

Gail McGruder 204 36%

Total 563 100%

To view the 2022 Trustee Election results, click here.>>

___________________________________________________________________________________________

Thinking about returning to work after retirement? Know the requirements! - Updated March 11, 2022

HMEPS has received inquiries about employees retiring and then returning to work part-time for the City of Houston, or providing their same services for the City of Houston as independent contractors or through third-party contractors.

HMEPS requires each retiring member to complete a “Certificate of Separation from Service with City of Houston” form, in which the member certifies, among other things, their separation or planned separation from employment with the City of Houston on a certain date (Separation Date), and that as of the Separation Date, the member will not be working for or providing services in any capacity for the City of Houston, including any other entity controlled, directly or indirectly, by the City of Houston.

For important information about working or providing services for the City of Houston after retirement, read the article, “Thinking of Returning to Work? Know the Requirements!” from the October 2018 Pension Press newsletter, which is also available here.

___________________________________________________________________________________________

We’re working to help keep the HMEPS community safe and healthy! - Updated March 7, 2022

The HMEPS Office Is Open for Scheduled In-Person Meetings. An in-person meeting with a Benefit Counselor requires an appointment.

- You can schedule an appointment with your Benefit Counselor by calling the HMEPS office at 713-595-0100 and following the phone prompts to reach your Benefit Counselor to set up the meeting.

- If you come to the HMEPS office without an appointment and want to meet with your Benefit Counselor, you can complete an appointment request form at the reception desk, and the request will be provided to your Benefit Counselor who will later contact you to schedule a meeting.

- HMEPS is continuing to provide participant services by telephone, through email and other electronic means, and by mail. Participants also can drop off completed documents in the Document Submission Box (see below for document submission).

Document Submission. If you are a participant and you want to submit your completed documents to HMEPS without a scheduled appointment, you can:

- Put your completed documents in the Document Submission Box located in the reception area (see instructions above the table).

- Mail your completed documents to the HMEPS office:

- HMEPS

1201 Louisiana, Suite 900

Houston, TX 77002

If you have any questions about submitting your documents, call the HMEPS office at 713-595-0100 and follow the phone prompts. Leave a detailed message, including your name and phone number, and a representative will follow up with you.

___________________________________________________________________________________________

2011 News & Updates

UPDATE 6-29-11

HMEPS and City of Houston Finalize Funding Agreement - June 29, 2011

Today, the Houston City Council approved the Amended and Restated Meet an Confer Agreement (Agreement) that was negotiated between HMEPS and the Mayor's office.

For more information, click here.

2012 News & Updates

UPDATE 1-24-12

Congratulations to Our Recently Elected Board Officers

In each odd-numbered year, the HMEPS Board of Trustees elects Board officers to the positions of Chairman, Vice Chairman and Secretary. At the January 24, 2013 meeting, the HMEPS Board unanimously re-elected Sherry Mose as Chairman, Roy W. Sanchez as Vice Chairman, and Lonnie Vara as Secretary. Each Trustee has demonstrated skill and leadership in their respective positions and the officers look forward to working with the Board to continue to strengthen HMEPS and provide excellent service to our participants.

UPDATE 10-25-12

DROP Interest Rate for Calendar Year 2013

The Deferred Retirement Option Plan (DROP) interest rate for calendar year 2013 will be 2.5%, effective January 1, 2013. The rate was approved by the HMEPS Board of Trustees at the October 2012 Board meeting.

Several DROP participants have asked how the DROP rate is determined. Under the Meet and Confer Agreement, the DROP interest rate for each calendar year is half (50%) of the HMEPS investment return for the prior fiscal year, with a maximum rate of 7.5% and a minimum rate of 2.5%. The HMEPS investment return for Fiscal Year 2012 was -0.14%. Because half of -0.14% is less than the minimum rate of 2.5%, DROP participants in 2013 will receive 2.5% on their DROP accounts.

DROP is an optional retirement method for members who have reached their normal retirement eligibility (age and years of credited service) but do not want to retire. It is an alternative method of accumulating and receiving a pension benefit from HMEPS. To speak with a benefit counselor to learn more about DROP, please call the HMEPS office at 713-595-0100.

UPDATE 9-21-12

Update on the Texas Legislature - September 12, 2012 PIFS Meeting

On September 12, 2012 the Texas House of Representatives Pensions, Investments and Financial Services (PIFS) Committee met to discuss several topics, including pensions. At the meeting, we reviewed for the Committee the history and current status of HMEPS, and answered questions from Committee members. Our primary message was that the existing Meet and Confer process works. A key reason it works is that one side cannot control the negotiation or unilaterally make changes. Good faith, arms-length negotiations, including appropriate checks and balances, are the essence of the process.

We were pleased to see that the City of Houston, in its written comments submitted to the Committee, agrees that the Meet and Confer process has been successful with HMEPS. Because of the City’s ability to negotiate with HMEPS under the State meet and confer law, the City, according to its statement, “has been able to make substantial progress in providing sustainable, secure retirement plans for…municipal employees.” (Click here for City of Houston "Rationale for Local Control of Pensions" document.)

Be assured that the responsible and professional trustees and staff at HMEPS are the sole fiduciaries of the system, and that we will remain vigilant in providing a secure retirement benefit for all our participants.

Sherry Mose

Chairman, HMEPS Board of Trustees

UPDATE 8-10-12

HMEPS Receives Award for Excellence in Financial Reporting

The Houston Municipal Employees Pension System (HMEPS) has been awarded the Certificate of Achievement for Excellence in Financial Reporting by the Government Finance Officers Association of the United States and Canada (GFOA) for its 2011 Comprehensive Annual Financial Report (CAFR).

According to the GFOA's release, "the Certificate of Achievement is the highest form of recognition in governmental accounting and financial reporting, and its attainment represents a significant accomplishment by a government and its management.”

“The CAFR was judged by an impartial panel to meet the highest standards of the program including demonstrating a constructive 'spirit of full disclosure' to clearly communicate its financial story and motivate potential users and user groups to read the CAFR."

"We are honored to be recognized by GFOA for our CAFR," said HMEPS Executive Director Rhonda Smith. "Accurate and transparent financial reporting is a top priority at HMEPS, and we are pleased to receive the award."

The GFOA is a non-profit professional association serving approximately 17,500 government finance professionals with offices in Chicago, IL and Washington, D.C. For more information visit www.gfoa.org.

UPDATE 4-9-12

HMEPS Highlighted As One of the Top Performing Local Public Retirement Systems in Texas

HMEPS is well-positioned to deliver secure benefits to its members and value to taxpayers for the long-term. HMEPS, while not immune to the effects of the recession, has weathered the storm better than most public pension systems in part because of sound management of its assets. HMEPS’ 2011 earnings on investments were 22.17%, which greatly exceeded our expected return of 8.5%, and our long-term returns are at and above our expected return.

To view the article please click here.

2013 News & Updates

DROP Interest Rate is 6.79% for Calendar Year 2014

The Deferred Retirement Option Plan (DROP) interest rate for calendar year 2014 will be 6.79%, effective January 1, 2014. The rate was approved by the HMEPS Board of Trustees at the October 2013 Board meeting.

Several DROP participants have asked how the DROP rate is determined. Under the Meet and Confer Agreement, the DROP interest rate for each calendar year is half (50%) of the HMEPS investment return for the prior fiscal year, with a maximum rate of 7.5% and a minimum rate of 2.5%. The HMEPS investment return for Fiscal Year 2013 was 13.58% so DROP participants in 2014 will receive 6.79% on their DROP accounts.

DROP is an optional retirement method for members who have reached their normal retirement eligibility (age and years of credited service) but do not want to retire. It is an alternative method of accumulating and receiving a pension benefit from HMEPS. To speak with a benefit counselor to learn more about DROP, please call the HMEPS office at 713-595-0100.

Max Patterson article "Houston's Pension Plan Funding Holds Up Under Scrutiny"

Max Patterson, Executive Director of the Texas Association of Public Employees Retirement Systems, wrote a letter that appeared in the Houston Chronicle's August 28th edition in response to Columnist Bill King's article. The article highlighted the strong returns of the City's pension systems. Click on the following link to read the full article:

Patterson: Houston's pension plan funding holds up under scrutiny

Houston Is Not Detroit - A Tale of Two Cities

In light of the City of Detroit's unfortunate filing for bankruptcy recently, some have asked if such a troubling event could occur with the City of Houston. The answer is almost certainly no. Indeed, a comparison of Detroit and Houston reveals two cities headed in opposite directions.

Detroit is, sadly, in decline, while Houston is ascending.

To continue reading, click here.

Visit HMEPS’ New Social Media Pages

As part of our efforts to stay connected with you, HMEPS is pleased to announce we are now on Facebook and Twitter. To visit the new Facebook page, click here. To follow us on Twitter, click here.

HMEPS Member Video

HMEPS is proud to present our Member Video, which highlights the fact that retirement pensions are vital earned benefits for our participants, and that those benefit payments also provide a strong boost to the Houston economy and the city's economic recovery. To view the video, click here.

UPDATE 1-24-13 - Congratulations to Our Recently Elected Board Officers

In each odd-numbered year, the HMEPS Board of Trustees elects Board officers to the positions of Chairman, Vice Chairman and Secretary. At the January 24, 2013 meeting, the HMEPS Board unanimously re-elected Sherry Mose as Chairman, Roy W. Sanchez as Vice Chairman, and Lonnie Vara as Secretary. Each Trustee has demonstrated skill and leadership in their respective positions and the officers look forward to working with the Board to continue to strengthen HMEPS and provide excellent service to our participants.

2014 News & Updates

HMEPS is Recognized for Fiduciary Excellence

We are pleased to announce the certification of the Houston Municipal Employees Pension System in the CEFEX Investment Steward program. The Centre for Fiduciary Excellence (CEFEX), announced today that it has certified the investment fiduciary practices of the Houston Municipal Employees Pension System as adhering to a global standard of excellence for Investment Stewards. HMEPS is among the first organizations in the world to successfully complete the independent CEFEX certification process.

We are pleased to announce the certification of the Houston Municipal Employees Pension System in the CEFEX Investment Steward program. The Centre for Fiduciary Excellence (CEFEX), announced today that it has certified the investment fiduciary practices of the Houston Municipal Employees Pension System as adhering to a global standard of excellence for Investment Stewards. HMEPS is among the first organizations in the world to successfully complete the independent CEFEX certification process.

Please click on the following link to view the formal release: News Release

DROP Interest Rate is 7.5% for Calendar Year 2015

The Deferred Retirement Option Plan (DROP) interest rate for calendar year 2015 will be 7.5%, effective

January 1, 2015. The rate was approved by the HMEPS Board of Trustees at the October 2014 Board meeting.

Under the Meet and Confer Agreement, the DROP interest rate for each calendar year is half (50%) of the HMEPS investment return for the prior fiscal year, with a maximum rate of 7.5% and a minimum rate of 2.5%. The HMEPS investment return for Fiscal Year 2014 was 16.39% so DROP participants in 2015 will receive 7.5% on their DROP accounts.

DROP is an optional retirement method for members who have reached their normal retirement eligibility (age and years of credited service) but do not want to retire. It is an alternative method of accumulating and receiving a pension benefit from HMEPS. To speak with a benefit counselor to learn more about DROP, please call the HMEPS office at 713-595-0100.

HMEPS Responds to Pension Misinformation

In a recent opinion piece in the Houston Chronicle – “Houston, there is a pension problem” (October 1, 2014) -- Daniel DiSalvo, a fellow at the Manhattan Institute provided inaccurate and misleading information regarding the Houston Municipal Employees Pension System (HMEPS).

• Mr. DiSalvo first asserts that the City of Houston's "fiscal prudence is under pressure from rising public employee pension and health care costs," but proceeds to single out only pensions for criticism. Not only is there no analysis of health care costs' impact on City finances, there is no mention at all of overall spending, revenue, debt service or how the City plans long term and manages its total financial commitments. Thus the piece unfairly leaves the impression that only pensions are to blame for the City's fiscal challenges, while the reality is far more complicated.

• DiSalvo criticizes HMEPS as being only 61% funded, but does not mention that a substantial portion of the system's current unfunded liability is due to the City not making its actuarially required contribution (ARC) payments to HMEPS in recent years. In fact, a mutually agreed upon funding schedule will, over time, meet the ARC requirements and reduce HMEPS' unfunded liability.

• Mr. DiSalvo states that "pension payments are projected to gobble up 17% of the City's budget by 2017.” In fact, the City projects that 13.9% of spending in 2017 will be for pensions. (Click here for a presentation from the July 29, 2014 Budget and Fiscal Affairs Committee.) HMEPS makes up only about 3% of the 2017 number. DiSalvo’s overstatement is likely the result of having calculated the pension contributions for all employees as a percentage of the City’s “General Fund.” This significantly overstates the percentage because there are thousands of employees who are not paid from the General Fund. This is a common error.

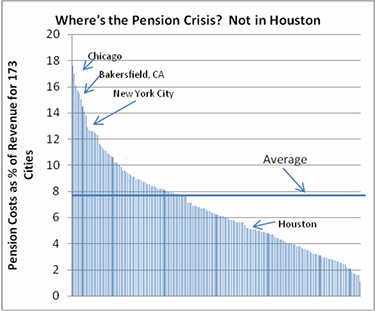

• What are the true costs to Houston taxpayers for pensions? A recent study by the Center for Retirement Research at Boston College, which was called by the New York Times “the nations leading center on retirement studies,”-- found that Houston's pension cost to taxpayers is below average (5.1% of government revenue), and far below those of other major cities, as shown in the following graph:

• Public employees did not create the City's financial problems, but HMEPS has worked with the City to be part of a reasonable, fair, long-term solution to those problems.

Sincerely,

Sherry Mose

Chairman

Election News and Updates

For information pertaining to the Trustee election, click here to go to the Election News and Updates section.

HMEPS Receives Award of Excellence in Financial Reporting for Twentieth Consecutive Year

The Government Finance Officers Association of the United States and Canada (GFOA) has awarded the Houston Municipal Employees Pension System (HMEPS) a Certificate of Achievement for Excellence in Financial Reporting for its 2013 Comprehensive Annual Financial Report (CAFR).

This is the twentieth consecutive year that HMEPS has been honored with a Certificate of Achievement by the GFOA. The GFOA established the CAFR recognition program in 1945 to encourage and assist state and local governments in reaching beyond the minimum requirements of generally accepted accounting principles in preparing CAFR reports.

“HMEPS is very proud to be awarded this recognition for the twentieth consecutive year,” said HMEPS Executive Director Rhonda Smith. “This is the highest form of recognition that the GFOA awards in governmental accounting and financial reporting. It is a significant accomplishment for HMEPS, and it reflects our deep commitment to accurate and transparent financial reporting.”

The GFOA is a non-profit professional association serving approximately 17,500 government financial professionals with offices in Chicago and Washington, D.C. For more information, visit www.gfoa.org.

City Commissioned Pension Report Ignores a Decade of Reform

At a recent City Council Budget and Fiscal Affairs Committee meeting, the City’s representative made a presentation on a variety of pension-related topics. The presentation summarized a report prepared by the City’s actuary, Retirement Horizons Inc. (RHI), that the City commissioned and that attempts to identify “cost savings” that can be realized through proposed cuts to benefits.

We have reviewed the RHI Report and identified numerous faulty assumptions and factual misstatements that make the Report's conclusions questionable and impossible to judge. HMEPS has prepared and submitted a response to the City that addresses the report’s inaccuracies and deficiencies, including its failure to acknowledge the hundreds of millions of dollars in future benefit reductions and savings that have been achieved through reforms that have already been implemented. You can read our full response here.

The RHI report ignores previous reforms. The City’s Report appears to claim that great improvements in the HMEPS funded level and in City contributions will occur over the next several decades if suggested pension cuts are made. But significant improvements will happen due to the reforms that have already been achieved over the last decade through the Meet and Confer process. These reforms eliminated over $850 million in future benefits and will lead to full funding of HMEPS within approximately 30 years with the City paying what it agreed to pay and without any further diminishment of benefits.

HMEPS and City leaders worked together over the past decade to make significant reforms to the plan to fix the liabilities and give the City a schedule for putting in the right amount of money. The City’s pension representative has reported that the HMEPS liabilities have been fixed. The other side of the equation requires the City to properly fund its obligations. However, when it comes time to pay what it owes, manufactured numbers in this City-commissioned Report are being used to strike at the core of retirement security by proposing cuts to benefits. These are benefits that the men and women who work for the City have earned honestly and with the reasonable expectation that those earned benefits will be provided in exchange for the services that help make this City great and that will benefit Houstonians for generations to come.

It is fashionable to scapegoat pensions as the principal source of the City’s finance challenges, but the reality is much more complicated and involves revenue, spending, debt service and how the City plans long-term and manages its total commitments. However, we note that Council Member Stephen C. Costello, Chairman of City Council’s Budget & Fiscal Affairs Committee, just released a new City Draft Financial Policy which includes “financing all post-employment and employee benefit systems in a manner to systematically fully fund all liabilities,” and which attempts to address the other more significant drivers of the City’s financial challenges. All stakeholders deserve a comprehensive review and discussion and not one solely focused on pensions.

As always, HMEPS strives to keep participants informed, and will work to provide a secure retirement benefit now and for decades to come.

Sincerely,

Sherry Mose

Chairman

City Files Lawsuit Against the Houston Firefighters’ Relief and Retirement Fund - 1/22/2014

The City of Houston announced that it had filed suit against the Houston Firefighters’ Retirement and Relief Fund (HFRRF) to gain “the same input on contributions and plan design for HFRRF that it already has with the Houston Police Officers Pension System (HPOPS) and the Houston Municipal Employees Pension System (HMEPS).” HMEPS is not a party to the lawsuit.

HMEPS is governed by a separate statute, and has a Meet & Confer Agreement with the City.

We will continue to monitor any legal action that could affect the system, and will remain vigilant on behalf of our participants.

Sincerely,

Sherry Mose

Chairman

DROP Interest Rate is 6.79% for Calendar Year 2014

The Deferred Retirement Option Plan (DROP) interest rate for calendar year 2014 will be 6.79%, effective January 1, 2014. The rate was approved by the HMEPS Board of Trustees at the October 2013 Board meeting.

Several DROP participants have asked how the DROP rate is determined. Under the Meet and Confer Agreement, the DROP interest rate for each calendar year is half (50%) of the HMEPS investment return for the prior fiscal year, with a maximum rate of 7.5% and a minimum rate of 2.5%. The HMEPS investment return for Fiscal Year 2013 was 13.58% so DROP participants in 2014 will receive 6.79% on their DROP accounts.

DROP is an optional retirement method for members who have reached their normal retirement eligibility (age and years of credited service) but do not want to retire. It is an alternative method of accumulating and receiving a pension benefit from HMEPS. To speak with a benefit counselor to learn more about DROP, please call the HMEPS office at 713-595-0100.

2015 News & Updates

DROP Interest Rate is 2.5% for Calendar Year 2016

The Deferred Retirement Option Plan (DROP) interest rate for calendar year 2016 will be 2.5%, effective January 1, 2016. The rate was approved by the HMEPS Board of Trustees at the October 2015 Board meeting.

Several DROP participants have asked how the DROP rate is determined. Under the Meet and Confer Agreement, the DROP interest rate for each calendar year is half (50%) of the HMEPS investment return for the prior fiscal year, with a maximum rate of 7.5% and a minimum rate of 2.5%. The HMEPS investment return for Fiscal Year 2015 was 3.38% so DROP participants in 2016 will receive 2.5% on their DROP accounts.

DROP is an optional retirement method for members who have reached their normal retirement eligibility (age and years of credited service) but do not want to retire. It is an alternative method of accumulating and receiving a pension benefit from HMEPS. To speak with a benefit counselor to learn more about DROP, please call the HMEPS office at 713-595-0100.

HMEPS Responds To Misleading Statements In TV And Radio Ads Made By Texans For Local Control

HMEPS would like to address the misleading statements being made in new TV and radio ads paid for by Texans for Local Control, an ideological, corporate-funded group. This group claims to support “local control” of the City’s pensions, but, in fact, argues only for total control by City officials who would be able to implement changes without negotiation. This control would extend to every aspect of pension systems, which would make HMEPS vulnerable to the kind of pension-plundering that was common in the private sector prior to ERISA legislation.

The television ad features a disgruntled former advisor to Houston Mayor Annise Parker who clearly is pushing an anti-pension agenda with scare tactics and irresponsible rhetoric. The ad also makes meaningless comparisons to Detroit. Houston has a growing population and tax base, while Detroit has been in decline for decades.

These ads urge viewers to ask municipal candidates to sign a pledge, but we want to assure our members that this so-called “pledge” is meaningless. There is nothing on the upcoming November 3rd election ballot regarding the local pension systems.

HMEPS welcomes the opportunity to engage in thoughtful and intelligent conversations regarding pensions, but these ads do nothing useful and only seek to mislead the public about the City’s pensions.

HMEPS has worked with the City of Houston through the meet and confer process to enact reforms that have strengthened the System for the long term, and we will continue to work responsibly and diligently to protect our participants’ hard-earned benefits.

Sincerely,

Sherry Mose

Chairman

TEXPERS Response to Misinformation

HMEPS is sharing with you two important articles regarding public pensions that were released Friday, September 4. The first one, which was published in the Houston Chronicle, is an opinion piece written by state Rep. Dan Flynn, R-Van, who is Chair of the Texas House Pensions Committee. The other is a press release written by the Texas Association of Public Employee Retirement Systems (TEXPERS) that corrects misinformation released last week by the Laura and John Arnold Foundation. HMEPS appreciates your taking the time to read these articles. If you have any questions, please contact HMEPS at 713-595-0100.

Article 1: Flynn: Political courage is key to sustaining pensions. (If you have trouble accessing this link, the complete article is included below.)

Article 2: TEXPERS Comments on Misinformation in Laura and John Arnold Foundation "Swamped" Whitepaper on Houston

Sincerely,

Sherry Mose

Chairman

Flynn: Political courage is key to sustaining pensions

Removing plans from state law will require careful consideration by the Legislature

In this year's legislative session, a discussion emerged regarding public pensions - specifically, Houston's pension plans - the costs associated with and the best way to govern those plans. But as we observed, there is not a one-size-fits-all solution to determine the best way to govern certain local pension plans.

Currently, Houston has three pension plans that are governed in two different ways. Houston's police and municipal pensions are governed by a system of meet-and-confer, which allows modifications in pension plan design, including changes to contribution rates, benefit levels and board composition.

This meet-and-confer structure requires an agreement by Houston's governing body and the pension's governing body. Under this system, Houston's governing body along with Houston's police and municipal plans have made several agreements to plan design changes that benefit all parties involved.

Houston's firefighter pension is structured differently. It requires a change in Texas statute before benefits can be changed. Typically the Legislature makes changes to statute based on an agreement by the city and the pension plan's administrators.

The Legislature usually does not act if there is local disagreement on the issue. During the 84th legislative session, a bill was introduced that would have solidified an agreement by Houston Mayor Annise Parker and the governing body of the firefighter pension. But some of Houston's council members disagreed with these changes. In the end, theLegislature left the system alone because an agreement was not reached at the local level. Some have suggested that all three of Houston's pension plans should be controlled solely by the city of Houston. Several bills introduced in the last legislative session sought to allow Houston to have sole control of its public pensions, but they did not pass. Such proposals cannot be passed without thorough consideration.

One of the reasons why some municipal plans require a statutory change or an agreement between the city and the plan's governing body is to provide long-term stability to the pension fund. Pensions require consistent planning and well-thought-out changes; what may seem like small changes in contributions or benefits today can have enormous effects on future fund liabilities. The Legislature's ability to take a long-term view of funding obligations helps inform public pension discussions in which long-term outcomes are usually decided in the short term.

This past session, there was a bipartisan agreement to address the severe underfunding of the Employee Retirement System of Texas. The Legislature did not solve the state's pension crisis without input from many different stakeholders. We used teamwork from all parties to draft the best plan possible.

By reaching an agreement to increase both the employer and employee contribution rates to a total of 19.5 percent, the Legislature was able to bring the system to actuarial soundness for the first time since 2002, with a 32-year amortization period. The state is now positioned to pay off its pension debt in 32 years. The success with ERS shows that pension plans that work with their stakeholders can achieve financial stability.

Therefore, before the Legislature considers removing local systems from state law - in effect removing stakeholder participation from pension governing bodies, along with local governments - we should figure out if the problems are unique to one or two local plans or if there is a systemic issue for all plans with similar governing structures.

We all know the issue of debt must be addressed to ensure that there is continued investment in Texas and so we can continue to enjoy the highest bond ratings that Wall Street has assigned us. If we continue to lead the nation in job growth and provide a sound working environment with opportunities for all, Texas will continue to be the best place for people to live, do business and raise their families.

The people covered under these state and local pension plans are a largepart of making that happen, and the benefit to all Texans will be taking care of what matters most: the jobs and long-term financial security of Texas teachers, state employees, firefighters, police and many others who take care of us every day. All options should be on the table. We should continue to have the political will to make the changes that make sense while remaining true to our commitment made to those covered in these systems.

Flynn, R-Van, represents Hunt, Hopkins and Van Zandt counties in the Texas House of Representatives and is chairman of the House Pensions Committee.

HMEPS Refutes Claims In Chronicle Article

The Houston Chronicle article on 7/6/2015 (“Houston’s debt outlook downgrade a warning, analyst says”) stated, “more than 95 percent of the $130 million general fund spending increase in Parker's budget this year is swallowed by contractual payments, namely pension obligations.”

We were surprised by this statement because the increase in pension expenditures attributable to the General Fund for the Houston Municipal Employees Pension System (HMEPS) is less than $7 million.

The contribution to the Houston Firefighters’ Retirement & Relief Fund is virtually unchanged, while the contribution to the Houston Police Officer’s Pension System increased by about $35 million – although more than $25 million of that was a catch-up from a recent underpayment (http://www.houstontx.gov/finance/five_year_plan_fy2016.pdf).

So, how can $42 million be 95% of $130 million? This is the kind of arithmetic we have grown accustomed to among the anti-pension crowd, and it is another reason that their proposed pension “fixes” lack realistic mathematical or policy grounding.

In any case, the article also says that this $42 million increase in pension payments (out of the $2.391 billion General Fund) is responsible for “crowding out” various services that the City would otherwise be able to provide. But in the same article, the $53 million the City lost due to revenue caps was called “modest.”

Perhaps the best response to these statements is to quote the Merriam-Webster dictionary for the word “propaganda” -- “ideas or statements that are often false or exaggerated and that are spread in order to help a cause, a political leader, a government, etc.”

In fact, the costs of pensions to Houston taxpayers are below the average for the U.S. and well below the problem situations found in Illinois and California (http://crr.bc.edu/wp-content/uploads/2013/11/SLP35-508.pdf).

HMEPS and the City of Houston have engaged in a series of major reforms over the last several years – the types of reforms that many cities are just beginning to consider (http://www.hmeps.org/assets/path-to-shared-reform_updated-2-2013.pdf). As a result of these reforms, the goal of 30 year full funding of the plan- agreed to by our City leaders- is well within reach.

We urge the Houston Chronicle and its readers to keep these facts in mind as anti-pension propaganda continues to come out in the future – as it inevitably will.

Sincerely,

Sherry Mose

Chairman

HMEPS' Response to Current Pension Legislation

As you may know, the 84th session of the Texas Legislature is underway in Austin. Over the next several months, House and Senate Members will consider hundreds of bills on a wide array of issues relevant to state government.

You should be aware that there are bills (specifically HB2608 and HB2955) that concern us a great deal. These bills have been dubbed by some as “local control” bills. But they are nothing of the sort.

In fact, local control already exists in the Meet & Confer process, which has worked extremely well for HMEPS and the City. These bills work directly against this well established process.

It is our job to inform and educate legislators about the participants of HMEPS and how any proposed legislation would affect them. In addition, the Meet & Confer agreement between the City and HMEPS requires both of us (as parties to the agreement) to oppose bills like these, which threaten this carefully constructed process. The Meet and Confer provides:

“…the Parties agree, cooperatively and separately, not to file or submit, and to oppose any legislation that is filed in or submitted to the Texas Legislature, in the form of a bill or an amendment to a bill, that would result in a reduction of benefits or in a change under the Statute, and/or that would affect any of the matters covered by the Agreement, unless such a change is mutually agreed to by the Parties.”

HMEPS' Board of Trustees and staff are highly engaged on these bills, as well as other pension-related legislation, and will keep you informed as the legislative process in Austin unfolds. We ask that you stand ready to engage with your elected officials should that be needed. As always, we will remain vigilant in protecting the system and our participants.

Should you have any questions or need further information, please call our office at (713) 595-0100.

Sincerely,

Sherry Mose

Chairman

2016 News & Updates

News Update - December 21, 2016

HMEPS is continuing to negotiate with Mayor Turner’s administration on mutually agreed pension reforms for proposed enactment by the Texas Legislature in 2017. As part of the negotiations, the proposed benefit reforms have been updated. An overview of the updated proposed benefit reforms is contained in the current issue of the HMEPS Pension Press, which is available by clicking here.

News Update - November 17, 2016

DROP Interest Rate is 2.5% for Calendar Year 2017

The Deferred Retirement Option Plan (DROP) interest rate for calendar year 2017 will be 2.5%, effective January 1, 2017. The rate was approved by the HMEPS Board of Trustees at the November 2016 Board meeting.

Several DROP participants have asked how the DROP rate is determined. Under the Meet and Confer Agreement, the DROP interest rate for each calendar year is half (50%) of the HMEPS investment return for the prior fiscal year, with a maximum rate of 7.5% and a minimum rate of 2.5%. The HMEPS investment return for Fiscal Year 2016 was 1.65%, so DROP participants in 2016 will receive 2.5% on their DROP accounts.

DROP is an optional retirement method for members who have reached their normal retirement eligibility (age and years of credited service) but do not want to retire. It is an alternative method of accumulating and receiving a pension benefit from HMEPS. To speak with a benefit counselor to learn more about DROP, please call the HMEPS office at 713-595-0100.

News Update - October 12, 2016

Over the past several months, HMEPS has worked diligently with the Mayor and his administration to secure future funding for the pension plan, and to make changes to the pension plan to continue to provide meaningful benefits for participants.

These changes are subject to HMEPS and the City mutually agreeing on funding matters and on implementation of the mutually agreed terms through legislation passed by the Texas Legislature in 2017. We will keep you updated on this site regarding the status of the negotiations.

Click here for an overview of the negotiated benefit changes.

News Update - September 15, 2016

HMEPS has been working with Mayor Sylvester Turner and his administration to address pension matters in a way that is mutually beneficial to both HMEPS participants and the City of Houston, and that brings about lasting reform for a sustainable retirement system.

Thus far, negotiations have resulted in proposed changes that we believe provide competitive benefits and future funding for the pension plan that are reasonable and actuarially sound, and that include stepped up payments to address past underfunding. The proposed changes will not be final unless and until a Meet and Confer agreement is reached between HMEPS and the City, with the expectation that the agreed provisions will be enacted into law by the Texas Legislature in the 2017 session.

We know these negotiations have caused concern among many of you, and we appreciate your continued patience and confidence as we work together toward a sound resolution. We believe it is important to work with Mayor Turner at the local level to develop a practical and tailored solution that is mutually agreeable rather than having the legislature work one out for us. We anticipate future adjustments to the COLA, DROP interest rate, member contributions and retiree death benefits, but no changes to eligibility for retirement or DROP, and no retroactive adjustments to earned or accumulated benefits.

We remain committed to a defined benefit plan that provides meaningful and competitive benefits with appropriate funding that will strengthen our participants’ financial future for the long term.

We are continuing our efforts with the City to develop a final agreement. Check this site for updates as we will keep you informed on the status of negotiations.

2016 Fall F.R.E.E. Summit, October 21, 2016

Mark your calendars! HMEPS and the City of Houston Deferred Compensation Plan will hold the 2016 Fall Financial Retirement Employees Educational (F.R.E.E.) Summit on Friday, October 21, 2016. The F.R.E.E. Summit will be held at the Harris County Department of Education Conference Center, 6300 Irvington, Houston, Texas 77022 from 9:30 a.m. to 2:15 p.m.

HMEPS Chairman and Manager of Policy and Financial Planning Meet with Mayor Turner

HMEPS Chairman Sherry Mose and Manager of Policy and Financial Planning Steve Waas, along with the administrators of the Houston Police Officers' Pension System and Houston Firefighters' Relief & Retirement Fund, met with Mayor Turner to discuss pension matters.

HMEPS Posting Notice of Determination Letter Request to IRS

HMEPS is having a notice posted at City locations and on the HMEPS website regarding HMEPS’ application to the Internal Revenue Service (IRS) for a determination letter on the qualification of the HMEPS plan. Upon application, the IRS issues a so-called "determination letter" that assures that the plan meets the detailed qualification requirements contained in the Internal Revenue Code at the time the letter is issued. The determination letter process is handled by the Employee Plans segment of the IRS's Tax Exempt and Government Entities Division.

A favorable determination letter indicates that the plan described in the written plan document meets Internal Revenue Code qualification requirements. HMEPS last received a favorable determination letter in November 2015. The IRS has a prescribed timetable for retirement plans to be submitted for an update of their determination letter, and this year is part of the window during which the IRS will accept updated submissions from governmental plans such as HMEPS. Accordingly, HMEPS is posting the notice as part of the determination letter request process.

2016 Pension Payment Schedule

The 2016 pension payment schedule is now available. Click here to download >>

DROP Interest Rate is 2.5% for Calendar Year 2016

The Deferred Retirement Option Plan (DROP) interest rate for calendar year 2016 will be 2.5%, effective January 1, 2016. The rate was approved by the HMEPS Board of Trustees at the October 2015 Board meeting.

Several DROP participants have asked how the DROP rate is determined. Under the Meet and Confer Agreement, the DROP interest rate for each calendar year is half (50%) of the HMEPS investment return for the prior fiscal year, with a maximum rate of 7.5% and a minimum rate of 2.5%. The HMEPS investment return for Fiscal Year 2015 was 3.38% so DROP participants in 2016 will receive 2.5% on their DROP accounts.

DROP is an optional retirement method for members who have reached their normal retirement eligibility (age and years of credited service) but do not want to retire. It is an alternative method of accumulating and receiving a pension benefit from HMEPS. To speak with a benefit counselor to learn more about DROP, please call the HMEPS office at 713-595-0100.

2017 News & Updates

News Update - November 8, 2017

On Tuesday, November 7th, City of Houston voters overwhelmingly approved Proposition A, which authorizes the City to issue $1 billion in pension obligation bonds to reduce public employee pension unfunded liability, including $250 million to HMEPS.

This election result is the culmination of nearly a year’s work by Mayor Sylvester Turner, HMEPS, the Texas Legislature and many other stakeholders on pension reform to preserve the long-term viability of the City’s public employee pension systems, and that work has progressed as planned. For more information on the pension reform, click here.

We will continue to keep our participants informed about any future developments which may affect the system, and we will remain vigilant in defending their hard-earned retirement benefits.

News Updates - October 26, 2017

DROP Interest Rate for Calendar Year 2018

The Deferred Retirement Option Plan (DROP) interest rate for calendar year 2018 will be 4.52%, effective January 1, 2018. The rate was approved by the HMEPS Board of Trustees at the October 2017 Board meeting.

The DROP interest rate calculation is set forth in SB 2190, which was enacted in the 85th Texas Legislature and amended the HMEPS Pension Statute. Under the amended Statute, the DROP interest rate as of January 1 of each year is a rate equal to half of HMEPS’ rolling five-fiscal-year investment return net of investment expenses, but not less than 2.5% nor more than 7.5%. The HMEPS net five-year investment return is 9.04%. Half of 9.04% is 4.52%. Therefore, DROP participants in 2018 will receive 4.52% interest on their DROP accounts.

DROP is an optional retirement method for Group A and Group B members who have reached their normal retirement eligibility (age and years of credited service) but do not want to retire. It is an alternative method of accumulating and receiving a pension benefit from HMEPS. To speak with a benefit counselor to learn more about DROP, please call the HMEPS office at 713-595-0100.

2% COLA beginning February 1, 2018

The cost of living adjustment (COLA) will be 2% beginning February 1, 2018.

The COLA calculation is set forth in SB 2190, which was enacted in the 85th Texas Legislature and amended the HMEPS Pension Statute. Under the amended Statute, the COLA is equal to HMEPS’ five-year investment return, based on a rolling five-year basis and net of investment expenses, minus the assumed rate of return less two percentage points, and multiplied by 50%, but not less than 0% nor more than 2%. The five-year investment return on HMEPS’ investments as of the end of fiscal year 2017 is 9.04%, and the 7% assumed rate of return less two percentage points is 5%, and half of the difference between the five-year investment return minus 5% is 2.02%, which is greater than the 2% maximum. Therefore, the COLA is 2%.

The COLA, not compounded, is applied to pension benefits for all group A retirees and group B retirees, and for all group D retirees who terminate employment on or after July 1, 2017 with at least five years of credited service, and survivor benefits for eligible survivors of a former member of group A or group B, or of a former member of group D who terminated employment on or after July 1, 2017 with at least five years of credited service, if such eligible person is receiving a pension or survivor benefit as of January 1 of the year in which the increase is made. For DROP, the COLA, not compounded, is applied only to the DROP account of an active DROP participant who is at least 62 years of age as of January 1 of the year in which the increase is made.

News Update - August 30, 2017

HMEPS Check Update

If you are expecting mail delivery of an HMEPS check, please be aware that the US Postal Service is experiencing service disruption due to Hurricane Harvey, and your check may be delayed.

News Update - May 31, 2017

Governor Abbott signed the pension reform bill (SB 2190) into law on May 31, 2017, with an effective date of July 1, 2017. Click here for an overview and FAQs on the benefit and contribution changes.

News Update - May 24, 2017

HMEPS Statement on the Texas Legislature’s Passage of Houston Pension Legislation

The 85th Texas Legislature has approved final passage of Senate Bill 2190, the pension legislation that involves the Houston Municipal Employees Pension System. SB 2190 now proceeds to Gov. Greg Abbott’s desk for his signature.

SB 2190 is the product of HMEPS working diligently with the City of Houston and various stakeholders for more than a year to protect our participants’ hard-earned benefits. Dedicated members of our Board of Trustees and staff traveled to Austin throughout the legislative session to meet with state lawmakers and their staffs and advocate on behalf of our participants. In addition, HMEPS participants answered the call to contact their respective legislators and made their voices heard on this important legislation.

HMEPS has worked hard to achieve reforms that protect our participants for the long term. SB 2190 largely reflects the terms agreed to by multiple stakeholders, including HMEPS. Going forward, be assured we will remain vigilant against any threats to your hard-earned pension and will keep you informed.

We will later be updating the HMEPS website with information regarding the legislation.

News Update - May 18, 2017

Legislative Update and Summary of Benefit and Contribution Changes

HMEPS is preparing for legislative changes to the pension plan that are expected to go into effect within the next few months. HMEPS has kept you informed both before and throughout the legislative session regarding the proposed benefit and employee contribution changes, which are summarized in the HMEPS December 2016 Pension Press Newsletter, available on our website at www.hmeps.org/Publications or by clicking here.

It is important that you use accurate information for your decision-making. There have been many articles in the media about contemplated changes to various police and fire pension systems in the state, which do not affect HMEPS or its members. We strongly recommend that you read the summary of the proposed benefit and employee contribution changes in the December 2016 Pension Press, which also addresses many of the questions participants have been asking about the changes. If you have a question that is not addressed in the Pension Press article, you should contact HMEPS for more information.

A few things that are not changing:

- There are no changes to eligibility requirements for retirement

- There are no changes to eligibility requirements for entering the DROP program

- There are no changes to the DROP program other than the interest and COLA crediting changes as summarized in the December 2016 Pension Press

- There are no changes to the accrual rates earned by active participants

We will continue to keep you updated on the status of the legislation and the benefit and contribution changes. We also frequently send email updates, so sign up now for these updates by providing your email address to HMEPS here. HMEPS will use your email address only for general communication and not for providing any personal or individualized information. We do not share personal email addresses with the City or any other third parties.

News Update - May 8, 2017

Legislative Update on SB 2190 - Houston Pension Reform Bill

Today the Texas House of Representatives took up SB 2190, the Houston pension reform bill. SB 2190 was substituted for HB 43 and passed out of the House this afternoon. The bill will now go to a conference committee to reconcile differences between the Senate version and the House version of SB 2190.

We will keep you updated as the bill continues to progress.

News Update - May 2, 2017

Senate passage of SB 2190

The Houston Chronicle reported yesterday’s passage of amended SB 2190 (Houston bill) by the Texas Senate. The bill now moves to the Texas House of Representatives where we will monitor its movement. SB 2190 contains a trigger for potential implementation of a separate cash balance retirement plan for new employees hired in or after 2027.

Now attention turns to the companion bill, HB 43 by Rep. Flynn. HMEPS is currently working with House members on that bill and we will keep you updated.

News Update - April 28, 2017

Thank you to the many members who recently contacted Representatives on the House Calendars Committee regarding HB 43. For those of you who made the call or sent an email, we were notified that your voices were clearly heard in Austin.

Your quick action and efforts are greatly appreciated! Until further notice, we ask that you stop calling and emailing the Representatives.

HMEPS

News Update - March 21, 2017

HMEPS Heads to Austin

Yesterday, as part of the Texas Legislature’s 85th Regular Session, the State Affairs Committee of the Texas Senate met to consider Senate Bill 2190, authored by committee chairwoman Joan Huffman (R-Houston), which deals with City of Houston employee pensions and would directly affect HMEPS.

As you may know, HMEPS has been working diligently with Mayor Sylvester Turner over the last year toward a pension reform package for consideration by the Legislature. Yesterday’s Senate committee hearing was the first consideration of SB 2190, which was approved by the State Affairs Committee. It will move on for consideration by the full Senate.

Sherry Mose, HMEPS Chairman of the Board of Trustees, traveled with staff to yesterday’s Senate hearing, and spoke on behalf of our participants. Chairman Mose spoke in support of the reform structure advocated by Mayor Turner, but cautioned that the reform mechanism is untested in the real world and must be carefully monitored. She voiced support for SB 2190, provided pending modifications, and removal of the requirement of a public vote to issue pension obligation bonds.

HMEPS takes our responsibility to keep you informed about your retirement benefits very seriously. We have worked hard to achieve reforms that protect HMEPS participants for the long term. The proposed legislation largely reflects the terms of our agreement with the City, but further modifications are needed. As the legislative session reaches its midpoint this week, there is much work yet to do, and you can be assured we will keep you informed regarding important developments.

2018 News & Updates

2018 HMEPS Trustee Election Results – August 31, 2018

We would like to congratulate Sherry Mose, Roy W. Sanchez and Roderick J. Newman on their re-election to the Board of Trustees.

In the 2018 Trustee Election conducted under the independent administration of Election-America, Inc. and certified by the Board at the August 23, 2018 Board meeting, Roy W. Sanchez was elected as the employee trustee in Position 6, and Roderick J. Newman was elected as the retiree trustee in Position 8. Sherry Mose, HMEPS Trustee and Chairman, was unopposed and was certified pursuant to state statute as elected to Trustee Position 5.

The following are the results of the 2018 Trustee Election:

2018 Election-Position 6

Eligible

Name Votes Cast

Roy Sanchez 371

Charles Morris 319

2018 Election-Position 8

Eligible

Name Votes Cast

Roderick J. Newman 795

James Moncur 736

To view the 2018 Trustee Election report, click here.

News Update - July 30, 2018

This is a reminder that the final phase-in of statutory contribution rate changes for Group A and Group B members takes effect on August 3, 2018. See below for more information:

• Group A members currently contribute 7% of pensionable pay (base salary, longevity and shift differential, if any) to HMEPS. Effective with the August 3, 2018 pay date, the contribution rate will be 8%.

• Group B members currently contribute 2% of pensionable pay (base salary, longevity and shift differential, if any) to HMEPS. Effective with the August 3, 2018 pay date, the contribution rate will be 4%.

• Group D members currently contribute 2% of pensionable pay (base salary, longevity and shift differential, if any) to HMEPS as member contributions. In addition, each Group D member currently contributes 1% of pensionable pay (base salary, longevity and shift differential, if any), which is credited to a notional cash balance account in the Group D member’s name. There are no further statutory contribution rate changes.

The contribution rate changes were part of the 2017 amendments to the HMEPS pension plan enacted by the Texas Legislature, as summarized in the June 2017 HMEPS Pension Press Newsletter, available here. See the HMEPS Benefits Handbook (as of July 2017) for more information on the pension plan.

News Update - January 31, 2018

Group D 1% Contribution to Cash Balance Account begins with February 2, 2018 pay date.

The 2017 Texas Legislature enacted legislation that included contribution and benefit changes for HMEPS participants. One of these changes is the introduction of a cash balance hybrid component for Group D members.

As explained in the June 2017 HMEPS Pension Press, if you were newly hired on or after January 1, 2008, then you are a Group D member and you will begin contributing 1% of your pensionable pay (base salary, longevity and shift differential, if any) to HMEPS effective with your February 2, 2018 pay date. The 1% contribution will be credited to a notional cash balance account in your name. This is in addition to your current member contribution of 2% of your pensionable pay to HMEPS.

What is the Cash Balance Account?

The cash balance account for Group D participants is a notional, or bookkeeping, account. If you are a Group D member, your cash balance account will be credited with your required 1% contribution. If you contribute to the cash balance account for at least one full year, your account will be credited with interest equal to half of the five-year average net investment return earned by HMEPS, and guaranteed to not be less than 2.5%, or greater than 7.5%. The balance in this account can be distributed to you when you leave employment with the City.

If you have any questions, contact HMEPS at 713-595-0100 and also refer to the HMEPS website for updates. Please note that representatives and employees from the City of Houston are not agents of HMEPS, and that you should contact HMEPS directly for information about your pension participation.

News & Updates

DROP Interest Rate for Calendar Year 2022 - Updated November 18, 2021

The Deferred Retirement Option Plan (DROP) interest rate for calendar year 2022 will be 6.2%, effective January 1, 2022.

The DROP interest rate as of January 1 of each year is equal to half of HMEPS’ net five-year investment return, but not less than 2.5% nor more than 7.5%. The HMEPS net five-year investment return is 12.39%. Half of 12.39% is 6.2%. Therefore, DROP participants in 2022 will receive 6.2% interest on their DROP accounts.

DROP is an optional retirement method for Group A and Group B members who have reached their normal retirement eligibility (age and years of credited service) but do not want to retire. It is an alternative method of accumulating and receiving a pension benefit from HMEPS. To speak with a benefit counselor to learn more about DROP, please call the HMEPS office at 713-595-0100.

COLA beginning February 1, 2022

The cost of living adjustment (COLA) will be the maximum 2.0% beginning February 1, 2022.

The COLA is equal to half of HMEPS’ net five-year investment return minus 5%, but not less than 0% nor more than 2%. The net five-year investment return on HMEPS’ investments as of the end of fiscal year 2021 is 12.39%, and half of the difference between the five-year investment return minus 5% is 3.7%, which is more than the maximum of 2.0%. Therefore, the COLA is 2.0%.

The COLA, not compounded, is applied to pension benefits for all group A retirees and group B retirees, and for all group D retirees who terminate employment on or after July 1, 2017 with at least five years of credited service, and survivor benefits for eligible survivors of a former member of group A or group B, or of a former member of group D who terminated employment on or after July 1, 2017 with at least five years of credited service, if such eligible person is receiving a pension or survivor benefit as of January 1 of the year in which the increase is made. For DROP, the COLA, not compounded, is applied only to the DROP account of an active DROP participant who is at least 62 years of age as of January 1 of the year in which the increase is made.

Cash Balance Account Interest Rate for Calendar Year 2022

The Group D Cash Balance Account interest rate for calendar year 2022 will be 6.2% (0.24% bi-weekly), effective January 1, 2021. The cash balance interest as of January 1 is a rate equal to half of HMEPS’ net five-year investment return, but not less than 2.5% nor more than 7.5%, and divided by 26.

The Cash Balance Account is provided under the HMEPS Pension Statute only to Group D members. Interest is credited bi-weekly on a Group D member’s contributions to the account, and is payable to a former Group D member with at least one year of service in the pension plan.

___________________________________________________________________________________________

The Coronavirus: What We Are Doing, How You Can Help - Updated April 30, 2020

Staying Safe

HMEPS continues to monitor conditions associated with COVID-19 (the Coronavirus), and to follow guidance on recommended measures to help ensure the health and safety of our participants, employees and others. Accordingly, HMEPS will continue to implement the following:

1. Until further notice, the physical location of the HMEPS office is closed to participants and other visitors. However, HMEPS representatives are working remotely to maintain services. To leave a message for an HMEPS representative, call the HMEPS office at 713-595-0100 and follow the phone prompts. Leave a detailed message, including your name, phone number and email address, and a representative will follow up with you by email

2. If you are a participant and you need to submit documents to HMEPS, you can send the document(s) to HMEPS by email at the email address provided by your Benefit Counselor. See above on how to contact your Benefit Counselor. Remember to retain the original document. You also can mail your submission to the HMEPS office:

HMEPS

1201 Louisiana, Suite 900

Houston, TX 77002

We will continue to evaluate additional measures as needs arise, and communicate changes on our website at www.hmeps.org. Thank you for your understanding and for helping to keep all the members of our community safe and healthy!

2019 News & Updates

DROP Interest Rate for Calendar Year 2019 - October 30, 2018

The Deferred Retirement Option Plan (DROP) interest rate for calendar year 2019 will be 4.11%, effective January 1, 2019. The rate was approved by the HMEPS Board of Trustees at the October 2018 Board meeting.

The DROP interest rate calculation is set forth in the HMEPS Pension Statute, as amended by SB 2190 in the 85th Texas Legislature. Under the amended Statute, the DROP interest rate as of January 1 of each year is a rate equal to half of HMEPS’ rolling five-fiscal-year investment return net of investment expenses, but not less than 2.5% nor more than 7.5%. The HMEPS net five-year investment return is 8.21%. Half of 8.21% is 4.11%. Therefore, DROP participants in 2019 will receive 4.11% interest on their DROP accounts.

DROP is an optional retirement method for Group A and Group B members who have reached their normal retirement eligibility (age and years of credited service) but do not want to retire. It is an alternative method of accumulating and receiving a pension benefit from HMEPS. To speak with a benefit counselor to learn more about DROP, please call the HMEPS office at 713-595-0100.

1.61% COLA beginning February 1, 2019

The cost of living adjustment (COLA) will be 1.61% beginning February 1, 2019.